Aging in Place

Aging in Place is of great interest to adults ages 55+ with 80% reporting they want to remain in their current home (aarp,2018). And post COVID-19 speculation appears to add interest to aging in place. Planning ahead is essential: 1) Assess Yourself. Take a truthful look at your physical abilities, financial positio and health (include chronic diseases) 2) Assess your community and local resources. 3) Do your Research. eldercare.acl.gov, National Association on Aging.org, National Council on Aging.org, American Psychological Association.org and medicare.gov and more on the web 4) Do home modifications. Start early to spread out the planning, supervision and cost over the years (check out Professional Certified Aging in Place Specialists trained by the National Association of Home Builders). 5) Stay connected with your friends & family. 6) Keep Learning-companies are catching the wave of the older consumer with classes, trips, technology, devices & gadgets, and health & beauty products.

Your Financial Skills

Take advantage of your current financial skills and simplify for the long-term. Many people auto-pay household bills, insurances and other monthly obligations (even your church donation can be auto-deducted). Consider consolidating account to fewer rather than more and create a physical list including account, contact names, your user name & password. Keep in your home safe or in your safety deposit box at the bank. For more information click Managing Your Money in Old Age by Eleanor Laise, Kiplinger, 4-2017 and At What Age Are You Too Old to Manage Your Money by Robert Powell, MarketWatch 5-2017.

Aging in Place Improvements

More than 80% of homeowners ages 55+ prefer to age in place and preparing your home might include 1)First Floor living 2)Improve interior lighting 3)Low-entry shower with grab bars 3)Comfort height toilets 19″ 4)Color contrast paint 5)Entry ramps and more. Professional Certified Aging in Place Specialists (CAPS) trained by the National Association of Home Builders are available to help older adults stay in their homes safely and securely. For more information and a comprehensive checklist National Association of Home Builders Aging in Place Remodeling Checklist, nahb.org

Improve Indoor Air

Aging and spending more time indoors can lead to respiratory, sleep, fatigue and even digestive problems because of unhealthy indoor air containing dust, radon, mold, bacteria from pet stains, chemicals from fragrances, cigarette smoke and other allergens. Improve your air: Vacumm carpets 1-2 times per week (hard-surface flooring is favored); Eliminate or clean clutter (it collects and retains dust); Change your filters and get ducts cleaned; Open a window for a fresh air blast (even in cold months) and use your fans to circulate; Test for radon (it’s colorless, orderless and raises the risk of lung cancer); Consider an air purifier and dehumidifier; and Contact professionals to solve severe problems. (HarvardHealth, 2018)

A Future Relocation?

Thinking of relocating in retirement? Questions to consider – Will it make me happy? How will I fill my weekdays and with whom? Can I visit loved ones easily? Are there available doctors, hospitals and medical resources? Will it fit within my budget? Will I rent or own? What about the moving logistics? Can I unwind it, if it doesn’t work out?

Exercise Saves $2,500 per Year

Regular exercise is estimated to save you $2,500 per year (Journal of the American Heart Association) on medical expenses (compared to those whose who don’t exercise). Do: 30 minutes of moderate exercise 5 days/week or vigorous activity 3 days/week. For more info check out this USA Today article, How exercising regularly could save you up to $2,500 a year, by Mary Bowerman, 1-5-2017

Where will you Live?

20% of Americans live in multigenerational homes (64 million) up from 12% in 1980. Longevity means figuring out where to live: in a family member’s home, renting a duplex from adult children, granny pod in the back yard or aging-in-place on your own. Banks are inventing new loan products for multigenerational families and the IRS has specific rules on letting folks live rent-free. Use multiple sources to get the info you need to make the right decision for you. We started with All Together Now article, by Katy McLaughlin, wsj.com, 5-31-2019; additional sources include this Money Matters section, your accountant, irs.gov and other trusted-source published writings.

Affordability: Retirement or Kids?

About 80% of parents help their adult children financially (Merrill Lynch, Age Wave, 2018). Ask yourself: 1) can we/I afford it? 2) is it helping them get a leg-up or perpetuating an unstainable lifestyle? Try setting a budget, or “gifting” one time per year; know what you do for one may become an expectation for your other kids; and consider task help and not cash if babysitting the grands one night a week allows your son/daughter time for a second job. For more information click Don’t Let the Kisds Wreck Retirement by Eleanor Laise, kiplinger.com, 7-2-2019

Gray Divorce Rises

Gray divorce (those ages 50+) is on the rise accounting for 1 in 4 divorces (2010); in 1990 it was 1 in 10. Longer lives, individual financial strength and feelings of disconnectedness are factors in the splits. Healing from divorce includes acceptance, transitions and allowing yourself time to grow. More info at 7 Surprising Facts About Gray Divorce by Kathy McCoy, psychologytoday.com, 9-25-2018 and Stage One: After a Gray Divorce: Survive by Barry Gold, huffpost.com, 3-7-2016

Gal Plan Power

Women live longer (statistically 5 years more than men in USA). Women are more likely to age alone and live in poverty (2X more than men). Whooa – what to do? Make a Plan:

1)Where to Live-retirement community, with family, Golden Girl style, on your own or other 2)Know your numbers-get help if you need it, yet know how much you have to live on. The earlier you do this, the better – you may need to work longer, part time or start a business 3)Keep up with technology (ride sharing is not just for over-served college kids)-medical devices, communication tools, self-driving cars, etc. can be helpful aging tools 4)Focus on your Health – exercise your body and your brain & eat healthy 5)Stay positive-have fun along the way; remember thinking positive actually helps your brain think positive.

And use resources like Fantastic55.com (and others out there) to keep learning so your journey will be smarter, easier and better.

Living Apart Together

Living Apart Together (LAT) or Living Apart Together in Later Life (LLAT) are couples who live separately to keep their independence yet pursue the intimacy of a couple. They may or may not be married. For LLATs considerations of children, grandchildren, finances, freedom and in-home division of labor are factors in choosing this type of relationship. US representative surveys suggest that 6-9% of couples are partnered unmarried. For more info: More Older Couples Stay Together Because They Live Apart, by Clare Ansberry, wsj.com, 7-2019; Living Apart Together by Constance Rosenblum, nytimes.com and Older Couples Are Increasingly Living Apart. Here’s Why by Judith Graham, Kaiser Health News, 5-11-2018

Manage the Money

In retirement, the inflows are usually less than your spending. Reviewing your budget helps and here are main areas to manage: Housing-you may want to downsize or get a roomie; Healthcare-medicine, specialty care, wellness; Travel & Shopping-budget & stick to it; Taxes and Inflation-know your numbers, plan ahead and manage. More info in Money Matters and read Jean Chatzky’s Biggest Retirement Budget Drainers and Ways to Lessen the Blow.

Taxed

With Tax season underway, the IRS reminds us (especially Seniors) they don’t: demand payment over the phone, ask for credit or debit card numbers or threaten to call the police. These calls are from scammers. Hang up. Report IRS Impersonation Scam Reporting on the IRS website or call 800-366-4484. For more information on this warning, click IRS Reminds Seniors to Remain Alert.

Is Gray the New Color of Divorce?

Gray divorce accounts for 25% of divorces, nearly twice the historical rate. Reasons include longevity (people living longer don’t want to be unhappy), interests (or lack of common interests), retirement schedules (a spouse may think a sandwich and everyday lunch partner is the norm), sex (interest in, frequency, changes in the physical aspects) and more. To move ahead experts say to develop a new life plan including your self-image, finances, spiritually, interests and more. Embrace, adapt and move forward. Here are a couple of in-depth articles that might help: Facing a Gray Divorce? Watch Out for These 7 Critical Issues by Joe Dillion, Divorce Mediator 10-18-2017 and This is Why Baby Boomers are Divorcing at a Stunning Rate by Angela Moore, 10-20-2018.

Cohabitators 50+ Growing

Cohabitators 50+ have risen 75% over the last 10 years and now make up about 25% of all couples choosing to live together. Consider formalizing issues like sickness, inheritances, pensions, social security and property to help keep your relationship happy. Click Why More Couples Over 50 are Cohabiting, not Marrying by Kay Manning, Chicago Tribune, 10-19-2017 to get more information.

Disposable $$$

In the USA, people 50+ control 70% of disposable income. Hence attitudes, products, services and marketing campaigns are changing to embrace “old folks” who are more important to companies and non-profits than past generations. US News & World Report Baby Boomer Report 2015, usnews.com

Your Barbie Dream House

Your Dream House and aging in place live happily ever after when: Main floor living is used for 1-level living; doorways are widened to 36″ with offset hinges; showers get safer with grab bars, low-entrances and hand held shower heads, use lever handles on doors and cabinets and more at Barbie’s Dream House is Not a Forever Home, aginginplace.com, 12-2018

Rightsize is Not Wrong

Rightsize your home for years of lower expenses – use the “found” monthly cash flow to make your money last longer, pay down debt and discover new experiences. About 20% of empty nesters plan to rightsize. Many want to lower expenses and stop cleaning rooms they don’t use anymore. The Investor’s Edge in usatoday.com explored downsizing in the article, Why Downsizing a Home Makes Sense by Adam Shell.

Aging in Place To-Do’s

Aging in place is favored by more than 80% of homeowners over the age of 55. It’s here before you know it, so work on it over time versus facing a crisis. Consider one-floor living, add lighting especially in hallways, bathroom and outside and declutter to minimize fall risk and more. There are even Certified Aging-in-Place Specialists that can provide expertise. How to Age-Proof Your Home, Pamela Oldham, HuffPost.com, 6-23-2017

Home Sweet Home

The Wall Street Journal confirms that there is a surplus of Senior housing at this time in the article, As Supply of Senior Housing Soars Baby Boomers Stay Put. Contributing factors include: the relatively good health of seniors, affordability, community and being digitally connected. Many Seniors prefer the idea of aging-in-place and new data suggests they will until they are 82+. Ester Fung, wsj.com, 10-31-2018

8 PreRetirement Steps

A Retirement Checklist: 8 Steps to Take Now might include deciding where to live and what to do with youself to be purposeful, how and when to pay off debt, re-budgeting that lowers work-related expenses and more. Click the link for the full article. Ken Moraif, Kiplinger.com, 10-17-2018

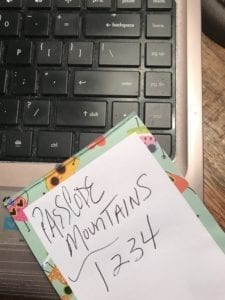

The Worst Things to Keep in Your Wallet (We are guilty!) This Kiplinger article helps protect us from crooks and ID thieves by removing these things from our wallet: Social Security card, Password cheat sheet, Spare Keys, Checks, Passport, Multiple credit cards, Birth certificate, Old Receipts and your Medicare card with your Social Security number on it. For more information, click the link to the full article. Bob Niedt, kiplinger.com, 8-17-2018

The Worst Things to Keep in Your Wallet (We are guilty!) This Kiplinger article helps protect us from crooks and ID thieves by removing these things from our wallet: Social Security card, Password cheat sheet, Spare Keys, Checks, Passport, Multiple credit cards, Birth certificate, Old Receipts and your Medicare card with your Social Security number on it. For more information, click the link to the full article. Bob Niedt, kiplinger.com, 8-17-2018

A Growing Number of People Are Navigating Retirement Alone 22% of those 65+ are either an elder orphan or at risk to be one. The road is navigable, yet it takes some planning including: 1) Team up with other elder orphans 2) Get your Financial Plan in order – know your numbers 3) Search out local resources 4) Create and keep your documents up-to-date and more. Elizabeth O’Brien, money.com 7-18-2018

A Growing Number of People Are Navigating Retirement Alone 22% of those 65+ are either an elder orphan or at risk to be one. The road is navigable, yet it takes some planning including: 1) Team up with other elder orphans 2) Get your Financial Plan in order – know your numbers 3) Search out local resources 4) Create and keep your documents up-to-date and more. Elizabeth O’Brien, money.com 7-18-2018

Senior House Sharing is on the Rise More boomers are going the roommate route for reasons including companionship, budget (women make less throughout their lives thus typically have less savings), middle-age divorce, shared task help and more. Some find roomies on Craigslist, Golden Girls Network or Senior HomeShares. Linda Abbit, seniorplanet.org, 10-16-2017.

Senior House Sharing is on the Rise More boomers are going the roommate route for reasons including companionship, budget (women make less throughout their lives thus typically have less savings), middle-age divorce, shared task help and more. Some find roomies on Craigslist, Golden Girls Network or Senior HomeShares. Linda Abbit, seniorplanet.org, 10-16-2017.

Meanwhile Back at the Ranch: Rethinking the Ranch for Aging in Place  Aging in Place is a real movement and Seniors are considering where and how to live out the last 1/3 of their lives. A ranch house may be right for you because of their one floor living, attached garage, open room options and more. Patrick Roden PhD, aginginplace.com, 8-16-2012

Aging in Place is a real movement and Seniors are considering where and how to live out the last 1/3 of their lives. A ranch house may be right for you because of their one floor living, attached garage, open room options and more. Patrick Roden PhD, aginginplace.com, 8-16-2012

Google is mulling a new market for Nest smart home products: Seniors As more and more Seniors choose to age in-place, companies are starting to see the potential in marketing to them as evidenced by Alphabet’s Nest home products. Nest (a division of Google) is doing research for Senior Smart homes that might include motion sensors that illuminate dark areas and track abnormal motion (meaning a fall or physical challenge). Nest research is reported to include cameras in the home with 2-way speakers (think Ring doorbell) which means a loved one can monitor and interact with an independent Senior on a 24-hour basis (kinda-living with them without living with them). Big picture – if/when Google gets into the Senior product market, you can bet others will too.

Social Security Issues Warning About Scams Similar to Those IRS Phone Scams Warning from the Social Security Administration: Do Not Give Personal Information over the Phone. According to this Forbes article, there are a couple of versions of these scams going around. Click the live link for the full article and advise your loved ones. Kelly Phillips Erb, forbes.com 7-20-2018

6 Social Security Myths That Could Make or Break your Retirement Planning

Your benefits may be a major part of your retirement funds and you’ll want to make your claiming decision the right decision. Here are a few myths to consider: it’s best to claim early, you have to claim when you retire, your marital status doesn’t matter, you can figure this out without research, you can’t change your mind and you social security account always reflects the facts of your work. Take the time to read this full article from CNBC’s Lorie Konish, Sharon Epperson, cnbc.com, 7-16-2018

Aging Populations: A Blessing for Business  Americans 50+ control more than 80% of the household wealth and the spending power of those 60+ will reach $15Trillion by 2020. Companies are taking notice. Look for new offerings, products, services and experiences to be offered and marketed to this demographic. Paul Irving, forbes.com, Next Avenue Contributor 2-23-2018

Americans 50+ control more than 80% of the household wealth and the spending power of those 60+ will reach $15Trillion by 2020. Companies are taking notice. Look for new offerings, products, services and experiences to be offered and marketed to this demographic. Paul Irving, forbes.com, Next Avenue Contributor 2-23-2018

Time Bomb Looms for Aging America 40% of households headed by people ages 55-70 don’t have the resources to maintain their lifestyle in retirement (note retirement could be 30+ years). This in-depth article by WSJ reporters Heather Gillers, Anne Tergesen and Leslie Scism offer the data and stats on how we got here. Some things people CAN do: stay in the workforce, develop a side hustle, save more, cut expenses and eat & stay healthy to keep medical costs down.

Business, Part-time or Fulltime Ideas

The national unemployment rate is down to 3.8%. So if you want to get into business or work full or part-time, here are some ideas for Boomers, Seniors & Retirees: Hospitality on your favorite deck, patio, winery, restaurant; Start a cart setup for coffee, ice cream, frozen water, lemonade, etc.; Be an Uber driver, dog walker, doggie/pet transportation carrier, family driver (especially when both parents work); Start a party planning business (painting, puppies, books, cooking, wine tasting, etc.); House sit, pet sit, baby/children sit; Set up a fruit stand or herb selling business; Resell used items on Craiglist, ebay or Facebook; Clean/organize garages, attics, etc; Clean outdoor patio grills, furniture, appliances; Make & Sell Handicrafts (paint & personalize seashells, signs, jewelry, scarves, kid’s clothes, or whatever) at summer festivals, shows and flea markets; Offer small catering, family personal chef or delivery family home-cooked meal service; Teach, be a teacher’s aide, tutor, work or volunteer at the library or museum; Start a Senior relocation planning services (especially in states where folks are moving to for tax or cost of living advantages – Florida & Texas come to mind; Do Small-job handyman work, room painter, window washer or small project worker; Be a Caretaker for outdoor flower gardens or flower pots or indoor plant/flower walls; And seasonal jobs at the flower, home & garden, tourist attractions, etc. We bet you can think of more! Email us and we’ll pass them on. [email protected]

The national unemployment rate is down to 3.8%. So if you want to get into business or work full or part-time, here are some ideas for Boomers, Seniors & Retirees: Hospitality on your favorite deck, patio, winery, restaurant; Start a cart setup for coffee, ice cream, frozen water, lemonade, etc.; Be an Uber driver, dog walker, doggie/pet transportation carrier, family driver (especially when both parents work); Start a party planning business (painting, puppies, books, cooking, wine tasting, etc.); House sit, pet sit, baby/children sit; Set up a fruit stand or herb selling business; Resell used items on Craiglist, ebay or Facebook; Clean/organize garages, attics, etc; Clean outdoor patio grills, furniture, appliances; Make & Sell Handicrafts (paint & personalize seashells, signs, jewelry, scarves, kid’s clothes, or whatever) at summer festivals, shows and flea markets; Offer small catering, family personal chef or delivery family home-cooked meal service; Teach, be a teacher’s aide, tutor, work or volunteer at the library or museum; Start a Senior relocation planning services (especially in states where folks are moving to for tax or cost of living advantages – Florida & Texas come to mind; Do Small-job handyman work, room painter, window washer or small project worker; Be a Caretaker for outdoor flower gardens or flower pots or indoor plant/flower walls; And seasonal jobs at the flower, home & garden, tourist attractions, etc. We bet you can think of more! Email us and we’ll pass them on. [email protected]

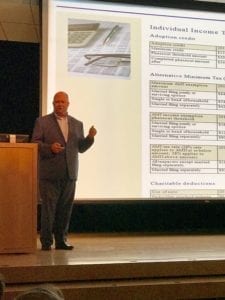

We had an opportunity to learn about changes in the tax code for individuals (not businesses) 2017 versus 2018 from Prudential. Here’s helpful information and an info graphic Breaking down the New Tax Bill, Prudential April 2018.

We had an opportunity to learn about changes in the tax code for individuals (not businesses) 2017 versus 2018 from Prudential. Here’s helpful information and an info graphic Breaking down the New Tax Bill, Prudential April 2018.

“Keeping your Mind Active” In this short YouTube video Meet Yaghob (Jake) Majidi-Kh whose encore consulting business keeps his wallet full and his mind sharp. Here’s his video story and some important words of advice.

“Keeping your Mind Active” In this short YouTube video Meet Yaghob (Jake) Majidi-Kh whose encore consulting business keeps his wallet full and his mind sharp. Here’s his video story and some important words of advice.

Fantastic Father’s Day Gift Ideas: Homies: Hire a gardener, handyman, window washer, gutter cleaner, or heating and cooling professional to spruce up dad’s house. Dating Dads: Subscription or lesson in online dating, tickets for a concert, theater production or comedy show, a spa certificate for a haircut or Sports Soak, or dance or cooking lessons to impress a new friend. Techie types: Stand-up desk, update his devices, fitness tracker, or smart home products that will make him an innovator in any circle. Active fellows: fly fishing lessons, new walking shoes, Pickleball paddle or an iFly Indoor skydiving gift card to keep him moving. Gourmet guys: Meal subscription, restaurant or brew pub gift certificates, or beer, wine or whiskey tasting party offer food, fun & frivolity. Smarties: a coding robot, the newest book or biography, attend a lecture with him at your local university or library or buy him a starter kit rocket package and have a blast.

Fantastic Father’s Day Gift Ideas: Homies: Hire a gardener, handyman, window washer, gutter cleaner, or heating and cooling professional to spruce up dad’s house. Dating Dads: Subscription or lesson in online dating, tickets for a concert, theater production or comedy show, a spa certificate for a haircut or Sports Soak, or dance or cooking lessons to impress a new friend. Techie types: Stand-up desk, update his devices, fitness tracker, or smart home products that will make him an innovator in any circle. Active fellows: fly fishing lessons, new walking shoes, Pickleball paddle or an iFly Indoor skydiving gift card to keep him moving. Gourmet guys: Meal subscription, restaurant or brew pub gift certificates, or beer, wine or whiskey tasting party offer food, fun & frivolity. Smarties: a coding robot, the newest book or biography, attend a lecture with him at your local university or library or buy him a starter kit rocket package and have a blast.

Award-winning painter, Grace Nowlin is finding her groove painting during her encore career. This painting is titled “Happy” and it certainly adds light to our hearts. Grace paints for the public, as well as commissioned pieces. See more at Grace Nowlin Art

Award-winning painter, Grace Nowlin is finding her groove painting during her encore career. This painting is titled “Happy” and it certainly adds light to our hearts. Grace paints for the public, as well as commissioned pieces. See more at Grace Nowlin Art

567 Ways to Collect Social Security Can you imagine – there were 567 different ways for a couple to claim their Social Security monies! And the laws change. In general, the longer you wait to collect, the larger your monthly benefit is (Jennie Phipps, Bankrate.com 12-2-2014). Just know that doing research, asking questions and being informed is a good path.

Other resources include Get What’s Yours: The Revised Secrets to Maxing Out Your Social Security by Laurence J. Kotikoff, Phillip Moeller and Paul Solman, 2016, The New Rules of Retirement, Second Edition by Robert C. Carlson, Social Security Simplified & Medicare Simplified by ClydeBank Finance, Social Security for Dummies by Jonathan Peterson, ssa.gov and an in-person visit to your local Social Security Administration.

Warren Buffett and Charlie Munger Riff on China, Guns and Crypto “Turds” Warren Buffett, 87 and Charlie Munger, 94  are going strong at their Berkshire Hathaway Annual Meeting. They discuss a myriad of topics, injected with intelligence and humor.Paul Glader, forbes.com, 5-9-2018

are going strong at their Berkshire Hathaway Annual Meeting. They discuss a myriad of topics, injected with intelligence and humor.Paul Glader, forbes.com, 5-9-2018

5 Reasons Buying a Tiny House is a Mistake 1)It’s a fad, 2)Buyers are few 3)They are less marketable 4)It’s too darn small 5)Added expense of storage, or party venue rental. Forbes.com 11-8-2017

30+ Senior Discounts on the Real Deal by Retailmenot app include AMC Theatres, American the Beautiful Senior Pass, Best Western, British Airways, Cinemark, Denny’s, Dunkin’ Donuts, Hertz, IHOP, Kohl’s, Outback Steakhouse, RiteAid, Royal Caribbean, Southwest Airlines, etc. Andrea Pyros, Savvy Shopping, 4-23-2016

Best and Worst States to Retire Rich How far does your retirement savings go in the state in which you live? Maybe you are looking to move to a more favorable state? This report shows state-by-state factors including taxes, living expenses, banking favor-abilities and health and social security costs/spending. Cameron Huddleston, wgobankingrates.com, 6-20-2017

Baby Boomers, like millennials, are flocking to rentals offering a “hands-free” lifestyle More than 5 million baby boomers are expected to rent their next home by 2020. They want no-maintenance and lots of amenities. Amy Zimmer, cnbc.com

Temporary and Part-Time Jobs from seasonal, to the gig economy, check out retiredbrains.com

10 Worst Mistakes People Make After Retirement 1)Maintaining their lifestyle 2)Not moving to more conservative investments 3)Applying for Social Security too quickly 4)Not cutting back on spending 5)Falling for a scam or fraud-hint: keep up-to-date with the news and talk to your friends to avoid someone or something nefarious 6)Not holding on to your pension long enough to avoid fees and taxes 7)Not being effective tax-wise during retirement 8)Supporting adult working children 9)Being house rich but cash poor 10)Not Staying socially and physically active. thefinancialworld.com, 11-1-2017

Planning Your Un-Retirement Continuing to work may starve off tapping your retirement accounts or Social Security benefits since money matters during retirement. Plus research shows working reduces isolation, leads to better physical and mental health and frames your identity. Suggestions on how to continue- decide on the same of a different industry, assess your skills and talents, build your resume while still employed, try the Gig Economy, give yourself room to financially breathe. Jean Chatzky, The Financial Freedom Studio, jackson.com, 10-29-2017

Downsizing in Retirement Allison Pearson talks of her personal experience in Retirement Planning. It was important that she and her spouse have the same goals. Starting with careers, both agreed that they want to work long into retirement years and then came the “where” to live discussion. Here is where a shared vision- not just where to live, but “how” to live is important. Don’s assume that you know what your partner wants. It is important to talk about it. Pearson says, “communication is absolutely critical to financial success and maintaining a healthy relationship with money.” Financial Freedom Studio, jackson.com 10-17-2017

Downsizing in Retirement Allison Pearson talks of her personal experience in Retirement Planning. It was important that she and her spouse have the same goals. Starting with careers, both agreed that they want to work long into retirement years and then came the “where” to live discussion. Here is where a shared vision- not just where to live, but “how” to live is important. Don’s assume that you know what your partner wants. It is important to talk about it. Pearson says, “communication is absolutely critical to financial success and maintaining a healthy relationship with money.” Financial Freedom Studio, jackson.com 10-17-2017

10 Places to Retire and Pay Way Less In Taxes 1)Alaska 2)Florida 3)Mississippi 4)Costa Rica 5)Malaysia 6)Panama 7)Ecuador 8)Philippines 9)Thailand 10)Uruguay businessadvicesource.com

The 10 Best Cities If You Want to Retire Early Cities were given scores for cost of living, quality of life and employment opportunities. 5)McAllen, TX, 4)Evansville, IN (tie), Hattiesburg, MS (tie), Cleveland, TN (tie), 3)Jonesburo, AR (tie), Wichita Falls, TX (tie), 2)Benton Harbor, MI (tie), Sherman, TX (tie), Memphis, TN (tie), 1)Knoxville, TN. Nick Clements, Forbes, 2017

5 Ways to Retire Without Money suggests 1)Retire where it is financially favorable 2)Trim expenses 3)Get rid of high interest debt 4)Work and stay busy 5)Don’t delay retirement so long that you can’t enjoy it. Greg Daugherty, 9-18-2017

Retirement Roommates: Were “The Golden Girls” Right? Living with roommates helps seniors with financial challenges, failing health issues and feelings of disconnectedness. More than 1/3 of boomers are single and having roommates is a viable option for sharing expenses, chores and occasions. Roommates are a build-in community, support and errand-sharing system. There are drawbacks, but start with clearly defined house rules – rental agreement, quiet times, visitor policy, maintenance, etc. Lori Martinek, nextavenue, 9-14-2017

Retirement Roommates: Were “The Golden Girls” Right? Living with roommates helps seniors with financial challenges, failing health issues and feelings of disconnectedness. More than 1/3 of boomers are single and having roommates is a viable option for sharing expenses, chores and occasions. Roommates are a build-in community, support and errand-sharing system. There are drawbacks, but start with clearly defined house rules – rental agreement, quiet times, visitor policy, maintenance, etc. Lori Martinek, nextavenue, 9-14-2017

Why We Need More Nonprofit Senior Housing – A plea to investors for more affordable housing with quality care. As the cultural shift in America becomes older, seniors are dealing with poverty and isolation and need more high-quality lower-cost residences. The author appeals to investors and governments to tackle this problem. Jess Stonefield, nextavenue, 9-14-2017

Naturally Occurring Retirement Communities (NORC): A Creative Housing Option Geographical communities where 40% of the population is 60+ and live in their own homes (90% of adults prefer to age in place). Support services for these (NORC-Supportive Service Programs) may include visiting nurse, social services, health care management, education, exercise class and volunteer programs. NORC Blueprint is a guide to this growing housing model. Sally Abrahms, extramile.com, 9-4-2017

Back to School Season & The Key to Hacking Both Work & Retirement Security is an in-depth look into continuing training and learning driven by the knowledge doubling curve – at the end of WWII, knowledge doubled every 25 years; today that happens about once per year! In today’s world where we live longer, learning is essential and new ways of learning will be developed. Joseph Coughlin, Forbes, 9-1-2017

5 Mistakes to Avoid In Retirement 1)Applying for Social Security benefits too early 2)Failing to take a more conservative investment approach 3)Not changing your spending habits 4)Miscalculating your Required Minimum Distributions 5)Underestimating health care costs when planning. forbes.com Investing, 8-2-2017

Is Your Retirement Plan as Well Thought Out as Your Vacation? helps you answer questions, provides information on healthcare and social security options using insights from professionals. Mark Pruitt, Strategic Estate Planning Services Inc, 8-2017

Seniors are Buying Tiny Homes to Live Their Golden Years Off the Grid, Companies like Next Door Housing, MEDCIs ottage and Tumbleweed Housese build tiny houses for seniors that want to downsize and travel. Jessica Stewart, My Modern Met Home/Architecture, 5-22-2017

Home away from home: Top 5 places to retire abroad. Natalia Wojcik, CNBC.com, 5-28-2017

3 Social Security surprises that may leave money on the table by Kellie B. Grant gives insight on checking your benefits online and making certain the numbers are correct. CNBC.com, 5-11-2017

62% of retirement age Americans can’t answer this question about retirement discusses retirement finances with emphasis on saving using the American College of Financial Services guideline that by age 30 you should have the equivalent of one year of your salary saved; by age 40 – three times; 50 – six times; 60 – 8 times; 67 – 10 times. CNBC.com, 5-4-2017

The Best Places To Retire in 2017, William P. Barrett, Forbes.com. 4-20-2017

2016 List of Most Popular Places to Retire; Florida cities include: Sarasota, Venice, Ft. Meyers, St. Petersburg, Pensacola, Naples, Clearwater, St. Augustine, Port Charles, Tampa, Jacksonville, Stuart, Frenandina Beach, Delray Beach, Dundin, Punta Gorda, Cape Cod, Boynton Beach, Vero Beach, Leesburg, Port St. Lucia, Key West, GolfPort, Juniper and Palm Coast. Florida for Boomers floridaforboomers.com, 2017